Economy

9 countries call for EU talks on ending trade with Israeli settlements

Nine European Union member states have urged the European Commission to propose measures to end EU trade with Israeli settlements in the occupied Palestinian territories, a report said Thursday.

The call was made by Belgium, Finland, Ireland, Luxembourg, Poland, Portugal, Slovenia, Spain and Sweden, according to a letter signed by the countries’ foreign ministers and addressed to EU foreign policy chief Kaja Kallas, Reuters said.

The EU is Israel’s biggest trading partner, accounting for about a third of its total goods trade. Two-way goods trade between the bloc and Israel stood at 42.6 billion euros ($48.91 billion) last year, though it was unclear how much of that trade involved settlements.

The ministers pointed to a July 2024 advisory opinion from the International Court of Justice (ICJ), which said Israel’s occupation of Palestinian territories and settlements there is illegal. It said states should take steps to prevent trade or investment relations that help maintain the situation.

“We have not seen a proposal to initiate discussions on how to effectively discontinue trade of goods and services with the illegal settlements,” the ministers wrote.

“We need the European Commission to develop proposals for concrete measures to ensure compliance by the Union with the obligations identified by the Court,” they added.

Belgian Foreign Minister Maxime Prevot said Europe must ensure trade policy is in line with international law. “Trade cannot be disconnected from our legal and moral responsibilities,” the minister said in a statement to Reuters.

“This is about ensuring that EU policies do not contribute, directly or indirectly, to the perpetuation of an illegal situation,” he said.

The ministers’ letter comes ahead of a meeting in Brussels on June 23, where EU foreign ministers are set to discuss the bloc’s relationship with Israel.

Ministers are expected to receive an assessment on whether Israel is complying with a human rights clause in a pact governing its political and economic ties with Europe, after the bloc decided to review Israel’s adherence to the agreement due to the situation in Gaza.

Israel’s genocidal war has devastated the Palestinian enclave, displacing nearly all its residents and killing more than 55,000 people, mostly women and children, according to local health authorities.

Economy

Chinese shippers defy tensions as exports top expectations in July

China’s exports exceeded forecasts in July, as manufacturers capitalized on a fragile tariff truce between Beijing and Washington to ship goods, particularly to Southeast Asia, ahead of tougher U.S. duties targeting transshipment.

Global traders and investors are waiting to see whether the world’s two largest economies can agree on a durable trade deal by Aug. 12 or if global supply chains will again be upended by the return of import levies exceeding 100%.

U.S. President Donald Trump is pursuing further tariffs, including a 40% duty on goods rerouted to the U.S. via transit hubs that took effect on Thursday, as well as a 100% levy on chips and pharmaceutical products and an additional 25% tax on goods from countries that buy Russian oil.

China’s exports rose 7.2% year-on-year in July, customs data showed on Thursday, beating a forecast 5.4% increase in a Reuters poll and accelerating from June’s 5.8% growth.

Imports grew 4.1%, defying economists’ expectations for a 1.0% fall and climbing from a 1.1% rise in June.

China’s trade war truce with the U.S. – the world’s largest consumer market – ends next week, although Trump hinted that further tariffs may be imposed on Beijing due to its continued purchases of Russian hydrocarbons.

“The trade data suggests that the Southeast Asian markets play an ever more important role in U.S.-China trade,” said Xu Tianchen, senior economist at The Economist Intelligence Unit.

“I have no doubt Trump’s transshipment tariffs are aimed at China, since it was already an issue during Trump 1.0. China is the only country for which transshipment makes sense, because it still enjoys a production cost advantage and is still subject to materially higher U.S. tariffs than other countries,” he added.

China’s exports to the U.S. fell 21.67% last month compared to the same period a year earlier, according to the data, while shipments to the Association of Southeast Asian Nations (ASEAN) rose 16.59% over the same period.

The levies are bad news for many U.S. trading partners, including the emerging markets in China’s periphery that have been buying raw materials and components from the regional giant and furnishing them into finished products as they seek to move up the value chain.

China’s July trade surplus narrowed to $98.24 billion from $114.77 billion in June. Separate U.S. data released on Tuesday showed that the trade deficit with China shrank to its lowest level in more than 21 years in June.

Despite the tariffs, markets showed optimism for a breakthrough between the two superpowers, with China and Hong Kong stocks rising in morning trade. Trump indicated earlier this week that he might meet Chinese President Xi Jinping later this year if a trade deal was reached.

Trade uncertainty

China’s commodities imports painted a mixed picture, with soybean purchases hitting record highs in July, driven by bulk buying from Brazil while avoiding U.S. cargoes. Analysts, however, cautioned that inventory building may have skewed the import figures, masking weaker underlying domestic demand.

“While import growth surprised on the upside in July, this may reflect inventory building for certain commodities,” said Zichun Huang, China economist at Capital Economics, pointing to similarly strong purchases of crude oil and copper.

“There was less improvement in imports of other products and shipments of iron ore continued to cool, likely reflecting the ongoing loss of momentum in the construction sector,” she added.

A protracted slowdown in China’s property sector continues to weigh on construction and broader domestic demand, as real estate remains a key store of household wealth.

Chinese government advisers are stepping up calls to make the household sector’s contribution to broader economic growth a top priority at Beijing’s upcoming five-year policy plan, as trade tensions and deflation threaten the outlook.

Reaching an agreement with the U.S. and the European Union, which have accused China of producing and selling goods at too low a price, would give Chinese officials more room to advance their reform agenda.

However, analysts expect little relief from Western trade pressures. Export growth is projected to slow sharply in the second half of the year, hurt by persistently high tariffs, President Trump’s renewed crackdown on the rerouting of Chinese shipments and deteriorating relations with the EU.

Economy

Climate change drives up global food prices, adds to societal risks

Extreme weather patterns and events resulting from climate change are causing the prices of food products, such as coffee, cocoa and rice, to rise in various countries and regions around the world, according to a report released on Thursday, citing a recently published study.

The increase in temperature and extreme weather events, such as floods and storms, caused by climate change, also affect agricultural activities and threaten food security.

In July, scientists from various research institutes in Europe conducted a study titled “Climate extremes, food price spikes and their wider societal risks.”

In the study, which examined the impact of climate change on food prices, scientists compiled reports highlighting the rise in food prices across different countries due to climate extremes.

According to the study, agricultural products affected by climate change vary according to their geographical location.

The severe droughts experienced in Southern Europe during 2022-2023 led to a 50% increase in olive oil prices across the European Union as of January 2024. Moreover, at the beginning of 2024 in the U.K., potato prices rose by 22% due to rainy weather conditions.

In East Asia, the heat waves in 2024 led to extreme temperatures in almost all of South Korea and Japan, as well as large areas of China and India. These extreme weather events increased the price of Korean cabbage by 70% in September 2024 compared to the same month the previous year. Japanese rice also rose by 48% during the same period. Additionally, vegetable prices in China increased by 30% in June and August.

Impact on various crops

In Vietnam, after the heat wave in February 2024, robusta coffee prices doubled by July. Similarly, in Indonesia, following the drought in 2023, rice prices increased by 16%.

And in Pakistan, food prices in rural areas rose by 50% within weeks following the devastating floods in August 2022. In neighboring India, following the heat wave in May 2024, onion and potato prices surged in the second quarter of the year. During this period, onion prices increased by 89% and potato prices by 81%.

In Australia, the floods in 2022 caused lettuce prices to rise. During this period, lettuce prices increased by staggering 300%.

After the heat wave in March 2024 in South Africa, corn prices rose by 36% in April. The 2022 drought in Ethiopia also had an adverse impact on food prices. Following the drought, food prices increased by 40% in March 2023.

At the same time, back in 2022, drought in the American states of California and Arizona, which provide over 40% of the national vegetable production, severely affected vegetable production. As of November 2022, vegetable prices in the U.S. increased by 80% in one year.

Following the 2023 drought in Mexico, there was a 20% increase in fruit and vegetable prices at the beginning of the following year.

Coffee, cocoa prices

Climate extremes not only caused price increases locally but also increased the global market prices of major food commodities such as coffee and cocoa.

The 2023 drought in Brazil, the world’s largest coffee producer, led to price increases. Global coffee prices rose by 55% in August 2024.

In Ghana and Ivory Coast, which account for about 60% of global cocoa production, extreme heat in February 2024 and ongoing prolonged drought from the previous year affected global cocoa prices. Cocoa prices increased by about 300% in one year as of April 2024.

Affecting numerous crops and spreading globally, the climate-induced surge in food prices can trigger various societal risks.

Increasing food prices, particularly for low-income households, significantly affects their food security. Such households may become less resistant to diseases due to inadequate nutrition, adding additional burdens to the health care system and increasing public expenditures.

Moreover, increases in food prices lead to a rise in overall inflation, posing significant risks for developing countries where the share of food prices in inflation is high.

Economy

Consortium with Turkish firms inks $4B deal to develop Damascus Airport

A five-company consortium led by Qatar’s UCC Holding and comprising three Turkish firms signed a $4 billion deal on Wednesday with the Syrian Civil Aviation Authority to develop and expand Damascus International Airport.

The deal was one of several agreements signed in Damascus during a ceremony attended by Syrian interim President Ahmed al-Sharaa, worth $14 billion, including infrastructure, transportation and real estate projects aimed at reviving the war-damaged economy.

Turkish companies Kalyon Holding, Cengiz Holding and TAV Construction, along with UCC Holding and Assets Investments from the U.S., will be involved in redeveloping Damascus International Airport, aiming to raise its annual passenger capacity to 31 million within eight years, an Anadolu Agency (AA) report said.

The deal marks one of the largest infrastructure projects in Syria in years, despite the country’s prolonged instability following more than a decade of civil war and the wider impacts of the second year of Israel’s genocidal war on Gaza and regional conflicts.

According to a statement from Kalyon Holding, the companies involved have carried out global-scale investments in energy, infrastructure and transportation both in Türkiye and abroad.

The new airport deal follows a $7 billion strategic cooperation agreement signed last May between the Syrian Ministry of Energy and the same core consortium, including Kalyon Holding, Cengiz Holding, UCC from Qatar and Power International from the U.S.

The agreement includes a 5,000 megawatt (MW) energy project, expected to generate approximately 35 billion kilowatt-hours (kWh) annually, supplying a significant share of Syria’s electricity needs.

‘To leave a legacy’

Chairperson of the board of Kalyon Construction, Murathan Kalyoncu, said the new airport deal reflects the group’s commitment to long-term regional development.

“As a domestic and national company, we have focused on people in every region we have operated in for 81 years and aim to leave a legacy for future generations,” he said.

“We successfully completed the construction of Istanbul Airport, Türkiye’s largest infrastructure project, in a record 42 months with a consortium including Cengiz Holding. We then elevated the airport to a global leadership position as a hub with an annual passenger capacity of 90 million.”

“Now, I wholeheartedly believe that with our management experience, engineering strength, technical competence and solution-oriented approach, we will make significant contributions to Damascus’s transformation into a regional air transportation hub,” Kalyoncu added. “I hope the massive investments we have undertaken will mark a turning point for Syria and provide significant support for regional development and stability.”

Alongside the airport investment, Syria signed a series of investment memoranda worth $14 billion on Wednesday, covering 12 strategic projects with several foreign firms.

Talal al-Hilali, director of the Syrian Investment Authority, said the agreements include a $4 billion deal with Qatar’s UCC Holding for the Damascus International Airport project, a $2 billion agreement with the UAE’s national investment corporation to build a metro line in Damascus, and a $2 billion contract with Italy-based UBAKO to develop Damascus Towers.

In July, Syria also signed $6.4 billion of investments with Saudi Arabia as it seeks to rebuild after years of civil war.

Economy

Slovenia bans imports from illegal Israeli settlements over Gaza crisis

The Slovenian government announced on Wednesday a ban on imports of goods from illegal Israeli settlements in the occupied West Bank, in a “symbolic measure” designed to ratchet up diplomatic pressure over the war in Gaza.

Slovenia’s government has frequently criticized Israel over the conflict and last year moved to recognize a Palestinian state as part of efforts to end the fighting in Gaza as soon as possible.

“The actions of the Israeli government … constitute serious and repeated violations of international humanitarian law,” the government said in a statement on Wednesday.

Slovenia “cannot and must not be part of a chain that enables or overlooks” such violations, it said, including the “construction of illegal settlements, expropriations, the forced evictions of the Palestinian population.”

The Slovenian government thus decided to “ban imports of goods originating from Israeli illegal settlements.”

Its latest move represents a “clear reaction to the Israeli government’s policy, which … undermines the possibilities for lasting peace and a two-state solution.”

“While symbolic,” the ban “is a necessary response to the ongoing humanitarian and security situation in Gaza,” Slovenia’s Foreign Minister Tanja Fajon said of the measure.

The government said that it was also examining a ban on exports of goods from Slovenia “destined for (the) illegal settlements,” saying that it would then “decide on further measures.”

According to the STA news agency, citing a government statement from January, Slovenia did not import any goods from Israeli settlements in 2022 and 2024, respectively.

In 2023, imports amounted to some 2,000 euros.

Early in July, Slovenia was the first EU country to ban two far-right Israeli ministers from entering the country.

It declared both Israelis “persona non grata,” accusing them of inciting “extreme violence and serious violations of the human rights of Palestinians” with “their genocidal statements.”

In June 2024, Slovenia’s parliament passed a decree recognizing Palestinian statehood, following in the steps of Ireland, Norway and Spain.

Economy

BoE cuts its main interest rate to 4%, lowest since early 2023

The Bank of England (BoE) lowered its main interest rate by a quarter percentage point to 4% on Thursday, as policymakers seek to bolster the sluggish U.K. economy.

Thursday’s decision was widely anticipated in financial markets as the bank’s Monetary Policy Committee (MPC) balances its responsibility to control inflation against concern that rising taxes and U.S. President Donald Trump’s global trade war may slow economic growth.

The committee voted 5-4 in favor of the cut.

The rate cut is the bank’s fifth since last August, when policymakers began lowering borrowing costs from a 16-year high of 5.25%. The Bank of England’s key rate – a benchmark for mortgages as well as consumer and business loans – is now at the lowest level since March 2023.

“There will be hopes that if loans become cheaper, it will help boost consumer and business confidence but there’s a long way to go,” Susannah Streeter, head of money and markets at Hargreaves Lansdown, said before the decision.

“In the meantime, speculation over potential tax rises in the Autumn Budget may keep households and companies cautious, given the uncertainty over where extra burdens may land.”

Policymakers decided to cut rates even though consumer prices rose 3.6% in the 12 months through June, significantly above the bank’s 2% target. The bank sees the recent rise in consumer prices as a temporary spike, due in part to high energy costs, and expects inflation to fall back to the target next year.

Against the backdrop, policymakers were faced with reports that the government may be forced to raise taxes later this year due to sluggish economic growth, rising borrowing costs and pressure to increase spending.

Britain’s unemployment rate rose to 4.7% in the three months through May, the highest level in four years, signaling that previous tax increases and uncertainty about the global economy are weighing on employers.

The U.K. economy grew 0.7% in the first three months of 2025 after stagnating in the second half of last year.

Economy

Higher US levies on dozens of countries come into effect

Higher U.S. tariffs imposed on dozens of economies came into effect on Thursday, raising the stakes in President Donald Trump’s wide-ranging efforts to reshape global trade.

As an executive order signed last week by Trump took effect, U.S. duties rose from 10% to levels between 15% and 41% for a list of trading partners.

Many products from economies including the European Union, Japan and South Korea now face a 15% tariff, even with deals struck with Washington to avert even steeper levies.

But others like India face a 25% duty – to be doubled in three weeks – while Syria, Myanmar and Laos face staggering levels at either 40% or 41%.

Taking to his Truth Social platform just after midnight, Trump posted: “IT’S MIDNIGHT!!! BILLIONS OF DOLLARS IN TARIFFS ARE NOW FLOWING INTO THE UNITED STATES OF AMERICA!”

The latest tariff wave of “reciprocal” duties, aimed at addressing trade practices Washington deems unfair, broadens the measures Trump has imposed since returning to the presidency.

But these higher tariffs do not apply to sector-specific imports that are separately targeted, such as steel, autos, pharmaceuticals and chips.

Chips tariffs

Trump said Wednesday he planned a 100% tariff on semiconductors – though Taipei said chipmaking giant TSMC would be exempt as it has U.S. factories.

Even so, companies and industry groups warn that the new levies will severely hurt smaller American businesses. Economists caution that they could fuel inflation and weigh on growth in the longer haul.

While some experts argue that the effects on prices will be one-off, others believe the jury is still out.

With the dust settling on countries’ tariff levels, at least for now, Georgetown University professor Marc Busch expects U.S. businesses to pass along more of the bill to consumers.

An earlier 90-day pause in these higher “reciprocal” tariffs gave importers time to stock up, he said.

But although the wait-and-see strategy led businesses to absorb more of the tariff burden initially, inventories are depleting and it is unlikely they will do this indefinitely, he told Agence France-Presse (AFP).

“With back-to-school shopping just weeks away, this will matter politically,” said Busch, an international trade policy expert.

Devil in the details

The tariff order taking effect Thursday also leaves lingering questions for partners that have negotiated deals with Trump recently.

Tokyo and Washington, for example, appear at odds over key details of their tariffs pact, such as when lower levies on Japanese cars will take place.

Washington has yet to provide a date for reduced auto tariffs to take effect for Japan, the EU and South Korea. Generally, U.S. auto imports now face a 25% duty under a sector-specific order.

A White House official told AFP that Japan’s 15% tariff stacks on top of existing duties, despite Tokyo’s expectations of some concessions.

Meanwhile, the EU continues to seek a carveout from tariffs for its key wine industry.

In a recent industry letter addressed to Trump, the U.S. Wine Trade Alliance and others urged the sector’s exclusion from tariffs, saying: “Wine sales account for up to 60 percent of gross margins of full-service restaurants.”

New fronts

Trump is also not letting up in his trade wars.

He opened a new front Wednesday by doubling planned duties on Indian goods to 50%, citing New Delhi’s continued purchase of Russian oil. But the additional 25% duty would take effect in three weeks.

Trump’s order for added India duties also threatened penalties on other countries that “directly or indirectly” import Russian oil, a key revenue source for Moscow’s war in Ukraine.

Existing exemptions still apply, with pharmaceuticals and smartphones excluded for now.

And Trump has separately targeted Brazil over the trial of his right-wing ally, former president Jair Bolsonaro, who is accused of planning a coup.

U.S. tariffs on various Brazilian goods surged from 10% to 50% but broad exemptions, including for orange juice and civil aircraft, are seen as softening the blow.

Still, key products like Brazilian coffee, beef and sugar are hit.

Many of Trump’s sweeping tariffs face legal challenges over his use of emergency economic powers, with the cases likely to ultimately reach the U.S. Supreme Court.

-

Politics2 days ago

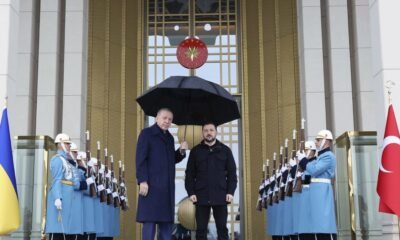

Politics2 days agoErdoğan to visit Ukraine, free trade on agenda: Envoy

-

Economy2 days ago

Economy2 days agoArgentina’s Milei vetoes pension, disability spending hikes

-

Daily Agenda3 days ago

Daily Agenda3 days agoHalf of us and hearts are comfortable nests peaceful

-

Sports2 days ago

Sports2 days agoBengisu Avcı makes Turkish sports history by conquering Ocean’s 7

-

Economy24 hours ago

Economy24 hours agoPublic land formula essential for transformation

-

Daily Agenda2 days ago

Daily Agenda2 days agoThe Chief of General Staff changed with the age decision

-

Daily Agenda3 days ago

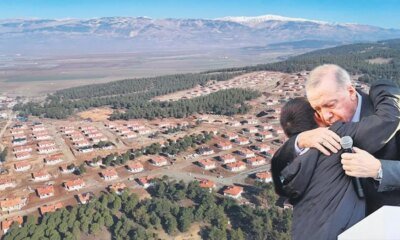

Daily Agenda3 days agoBrand new Kahramanmaraş with the power of the state in 2.5 years

-

Daily Agenda2 days ago

Daily Agenda2 days agoWe secure the future of our nation