Economy

Air Canada reaches deal with flight attendant union to end strike

Air Canada’s unionized flight attendants reached a deal with the country’s largest carrier on Tuesday, ending the first strike by its cabin crew in 40 years that had upended travel plans for hundreds of thousands of passengers.

The union first announced the agreement early Tuesday after talks with Air Canada resumed talks late Monday for the first time since the strike began over the weekend and at the peak of the summer travel season.

Air Canada said it would gradually resume operations as of Tuesday evening and a full restoration may require a week or more, while the union said it has completed mediation with the airline and its low-cost affiliate Air Canada Rouge.

“The Strike has ended. We have a tentative agreement we will bring forward to you,” the Canadian Union of Public Employees (CUPE) said in a Facebook post, as the strike entered its fourth day.

The carrier had earlier offered a 38% increase in total compensation for flight attendants over four years, with a 25% raise in the first year, which the union deemed insufficient.

The flight attendants walked off the job on Saturday after contract talks with the carrier failed. They had sought pay for tasks such as boarding passengers, which are not remunerated. They are now paid for time when the plane is moving.

The CUPE, which represents Air Canada’s 10,400 flight attendants, wanted to make gains on unpaid work that go beyond recent advances secured by their counterparts at U.S. carriers like American Airlines.

“Unpaid work is over. We have reclaimed our voice and our power,” the union said in a statement. “When our rights were taken away, we stood strong, we fought back – and we secured a tentative agreement that our members can vote on.”

In a rare act of defiance, the union remained on strike even after the Canada Industrial Relations Board declared its action unlawful.

Their refusal to follow a federal labor board order for the flight attendants to return to work had created a three-way standoff between the company, workers and the government.

Labor leaders objected to the Canadian government’s repeated use of a law that cuts off workers’ right to strike and forces them into arbitration, a step the government took in recent years with workers at ports, railways and elsewhere.

Jobs Minister Patty Hajdu had urged both sides to consider government mediation and raised pressure on Air Canada, promising to investigate allegations of unpaid work in the airline sector, a key complaint of flight attendants who say they are not paid for work on the ground.

Flight attendants have for months argued new contracts should include pay for work done on the ground, such as boarding passengers.

Air Canada operates around 700 flights per day. The airline estimated Monday that 500,000 customers would be affected by flight cancellations.

The carrier and its low-cost affiliate Air Canada Rouge normally carry about 130,000 customers a day. The airline is also the foreign carrier with the largest number of flights to the U.S.

Aviation analytics firm Cirium said that as of Monday afternoon, Air Canada had called off at least 1,219 domestic flights and 1,339 international flights since last Thursday, when the carrier began gradually suspending its operations ahead of the strike and lockout.

Passengers whose flights are impacted will be eligible to request a full refund on the airline’s website or mobile app, according to Air Canada.

Chief executive Michael Rousseau said restarting a major carrier is a complex undertaking. The airline said regular service may require seven to 10 days and some flights will be canceled until the schedule is stabilized.

“Full restoration may require a week or more, so we ask for our customers’ patience and understanding over the coming days,” Rousseau said in a statement.

Economy

Trump accuses Fed’s Powell of ‘hurting’ housing industry in new attack

U.S. President Donald Trump again attacked Federal Reserve (Fed) Chair Jerome Powell on Tuesday, saying he is “hurting” the housing industry “very badly” and repeated his call for a big cut to U.S. interest rates.

“Could somebody please inform Jerome ‘Too Late’ Powell that he is hurting the Housing Industry, very badly? People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut,” Trump wrote on Truth Social.

Inflation is well off the highs seen during the pandemic, but some recent data has given a mixed picture and inflation continues to track above the Fed’s 2% target range.

Trump’s latest salvo against Powell comes ahead of the Fed chair’s Friday speech at the annual Jackson Hole central banking symposium, where investors will cleave to his every word for hints on his economic outlook and the likelihood of a coming reduction to short-term borrowing costs.

The Fed’s next policy meeting will be held on Sept. 16-17.

Investors and economists are betting the Fed will cut rates by a quarter of a percentage point next month, with perhaps another reduction of similar size to come later in the year, far less than the several percentage points that Trump has called for.

Trump’s Treasury Secretary Scott Bessent has promoted the idea of a half-point rate cut in September.

The U.S. central bank cut its policy rate half a percentage point last September, just before the presidential election, and trimmed it another half of a percentage point in the two months immediately following Trump’s electoral victory, but has held it steady in the 4.25%-4.50% range for all of this year.

Fed policymakers have worried that Trump’s tariffs could reignite inflation and also felt the labor market was strong enough not to require a boost from lower borrowing costs.

Mixed inflation picture

Consumer price inflation in the U.S. rose 0.2% in July, with the 12-month rate at 2.7%, unchanged from June.

Core inflation, which strips out the volatile food and energy components, increased 3.1% year-over-year in July. Based in part on that data, economists estimated the core Personal Consumption Expenditures Price Index rose 0.3% in July. That would raise the year-over-year increase to 3%. The PCE is a key measure tracked by the Fed against its own 2% inflation target.

And despite a moderate rise in overall consumer prices in July, producer and import prices jumped, a suggestion that higher consumer prices could be coming as sellers pass higher costs onto households. The inflation picture comes amid a picture of a possible cooling in the labor market, with declines in monthly job gains, although the unemployment rate, at 4.2%, remains low by historical standards.

Trump’s online attacks on the Fed and Powell more typically focus on the cost that higher interest rates mean for U.S. government borrowing. High mortgage rates are a key pain point for potential homebuyers who are also facing high and rising home prices due to a dearth of housing supply.

Mortgage rates can be loosely tied to the Fed’s overnight benchmark rate but more closely track the yield on the 10-year Treasury note, which typically rises and falls based on investors’ expectations for economic growth and inflation. A Fed rate cut does not always mean lower long-term rates – indeed after the Fed cut rates last September, mortgage rates, which had been on the decline – rose sharply.

In recent weeks, the most popular rate – the 30-year fixed mortgage rate – has drifted downward but, at around 6.7% most recently, is still much higher than it had been before inflation took off after the pandemic shock and the Fed began its rate-hike campaign in 2022.

Economy

Higher airfare, food prices push UK inflation to 18-month high

Inflation in the United Kingdom rose more than expected to its highest in 18 months in July, driven by higher food and airfare costs, official figures showed on Wednesday, once again leaving the country with the fastest rate of price increases among the world’s largest economies.

The Office for National Statistics (ONS) said consumer price inflation was 3.8% in the year to July, up from 3.6% in June, tempering market expectations that the Bank of England (BoE) will cut interest rates again this year.

Most economists had anticipated a more modest rise in inflation to 3.7%.

With inflation now at its highest rate since January 2024 and nearly double the Bank of England’s target of 2%, the prospects of another rate cut in 2025 are diminishing.

Inflation in Britain’s services sector – which is watched closely by the Bank of England – accelerated to 5% from 4.7% a month earlier.

The BoE expected headline inflation to rise to 3.8% in July but had forecast a smaller 4.9% rise in services prices.

The latest increase is another blow to the Labour government, which was partly propelled into power last July because of the cost-of-living crisis, which saw inflation rise to over 11% at one time.

Treasury chief Rachel Reeves acknowledged there was “more to do to ease” the cost-of-living.

Rate cut hope ‘extinguishes’

The central bank cut its main interest rate by a quarter of a percentage point to 4% earlier this month, but only after a narrow 5-4 vote by policymakers and it suggested it would slow the already gradual pace of lowering borrowing costs due to inflation’s persistence.

That marked its fifth reduction in a year, when policy makers began lowering borrowing costs from a 16-year high of 5.25%. The Bank of England’s key rate, a benchmark for mortgages as well as consumer and business loans, is now at the lowest level since March 2023.

Sterling rose slightly after the data was published and investors expected a longer wait before the next rate cut.

“July’s outturn probably extinguishes hope of a September interest rate cut, while strengthening underlying inflationary pressures calls into question whether policymakers will be able to relax policy again this year,” said Suren Thiru, economics director at the chartered accountants institute ICAEW.

A quarter-point cut is not fully priced in until March 2026. Earlier this month, the next rate cut was viewed as highly likely before the end of 2025.

“The economy is experiencing a bout of high inflation and weak growth that will likely remain until next spring,” said Deloitte Chief Economist Ian Stewart. He said it was unclear whether the BoE would cut rates again in 2025.

The BoE thinks British inflation will hit 4% in September, double its target, and stay above 2% until mid-2027.

Inflation the United States held at 2.7% in July and in the eurozone, it is expected to remain around the European Central Bank’s (ECB) 2% target over the coming years.

Some of the difference reflects how energy and other utility prices are regulated in Britain. Big increases in utility bills in April have boosted year-over-year inflation comparisons.

Britain’s relatively tight labor market, which economists say has become more rigid since Brexit, is also putting upward pressure on prices. Wage growth in Britain has slowed but at about 5% it is too high for the BoE to feel comfortable about inflation returning rapidly to 2%.

Furthermore, employers say that a tax increase imposed on them in April by Treasury chief Rachel Reeves and a big jump in the minimum wage are forcing them to put up prices.

Higher airfares

Wednesday’s data showed the biggest contributor to July’s rise in inflation came from transport costs, particularly airfares – a component that BoE policymakers sometimes disregard because of its volatility.

Airfares soared by 30.2% between June and July, the biggest jump since the collection of monthly data began in 2001.

Electricity prices, petrol, soft drinks and hotel rooms also pushed up the annual rate of inflation between June and July.

The ONS said it saw no evidence that a tour by rock band Oasis pushed up hotel costs. Previous tours by performers such as Taylor Swift nudged up inflation, some economists have said.

Food and non-alcoholic drink prices – big influences on how the public thinks about inflation – were 4.9% higher than a year earlier, the biggest rise since February 2024. The BoE forecasts food inflation will peak at 5.5% at the end of the year.

ONS data last week painted a picture of an economy with enough momentum to keep inflation high. Output grew by more than expected in the second quarter and the labor market, while still losing jobs, showed signs of stabilization.

Data published earlier on Wednesday showed basic pay settlements by British private-sector employers held at 3% in the three months to July for the eighth monthly report in a row by data firm Brightmine.

The ONS, which has received criticism for problems with its data, said it had identified a “minor error” in the imputation of missing data for seasonal items but it had no impact on headline CPI.

Economy

US adds over 400 product categories to steel, aluminum tariffs list

The United States on Tuesday said it was hiking steel and aluminum tariffs on more than 400 products including wind turbines, mobile cranes, appliances, bulldozers and other heavy equipment, along with railcars, motorcycles, marine engines, furniture and hundreds of other products.

The Commerce Department said 407 product categories are being added to the list of “derivative” steel and aluminum products covered by sectoral tariffs, with a 50% tariff on any steel and aluminum content of these products plus the country rate on the non-steel and non-aluminum content.

Evercore ISI said in a research note the move covers more than 400 product codes representing over $200 billion in imports last year and estimates it will raise the overall effective tariff rate by around 1 percentage point.

The Commerce Department is also adding imported parts for automotive exhaust systems and electrical steel needed for electric vehicles to the new tariffs as well as components for buses, air conditioners as well as appliances including refrigerators, freezers and dryers.

A group of foreign automakers had urged the department not to add the parts, saying the U.S. does not have the domestic capacity to handle current demand.

Tesla unsuccessfully asked Commerce Department to reject a request to add steel products used in electric vehicle motors and wind turbines, saying there was no available U.S. capacity to produce steel for use in the drive unit of EVs.

The new tariffs take effect immediately and also cover compressors and pumps and the metal in imported cosmetics and other personal care packaging like aerosol cans.

“Today’s action expands the reach of the steel and aluminum tariffs and shuts down avenues for circumvention – supporting the continued revitalization of the American steel and aluminum industries,” said Under Secretary of Commerce for Industry and Security Jeffrey Kessler.

Steelmakers including Cleveland Cliffs, Nucor and others had petitioned the administration to expand the tariffs to include additional steel and aluminum auto parts.

Since returning to the presidency, President Donald Trump has imposed a 10% tariff on almost all U.S. trading partners, alongside varying steeper levels on dozens of economies such as the European Union and Japan.

Certain sectors have been spared from these countrywide tariff levels but instead were targeted under different authorities by even higher duties.

In the case of steel and aluminum, Trump initially unveiled a 25% tariff on imports of both metals before doubling this to 50% in June.

Though the impact of Trump’s tariffs on consumer prices has been limited so far, economists warn that their full effects are yet to be seen.

For now, some businesses have coped by bringing forward purchases of products they expected will encounter tariffs. Others have passed on additional costs to their consumers, or absorbed a part of the fresh tariff burden.

But analysts note that importers and retailers will unlikely be able to eat these costs indefinitely, and could eventually raise more consumer prices.

Some economists argue that the inflation hit will be one-off, but others are wary of more persistent effects.

The latest Commerce Department additions came after a window for the public to submit product inclusion requests.

Economy

Spotify to open Türkiye office amid chart scrutiny, artist complaints

Spotify will establish a local office in Türkiye in 2026, Culture and Tourism Minister Mehmet Nuri Ersoy announced on Tuesday, a development that follows a formal investigation and mounting criticism from artists over the company’s chart compilation practices.

The office will address “an important deficiency” and strengthen collaboration between the music streaming giant and Turkish artists, Ersoy said on social media platform X.

The announcement came after Ersoy met with Spotify representatives in Ankara. He said concrete progress would soon be made to ensure Türkiye’s music ecosystem receives the support it deserves from Spotify.

The company has faced backlash from Turkish artists over what they describe as a lack of transparency in how its charts are compiled. Spotify has also been accused of censorship and preferential treatment.

Reports had also suggested Spotify launched an internal investigation into its editors in Türkiye following allegations of bribery linked to local charts, though the company later denied this.

Last month, the Turkish Competition Authority (RK) launched an investigation into “various allegations that the strategies and policies implemented by Spotify” in Türkiye have caused anti-competitive effects in the music industry.

The regulator said the probe would examine whether the Swedish company gave more visibility to some artists and engaged in unfair practices in the distribution of royalties, thereby violating competition law.

The company said its operations complied with “all applicable laws” but would cooperate with the investigation.

“Spotify will establish its office in Istanbul in 2026, deepening collaborations in this field,” said Ersoy. “We will sit down with company representatives and our music industry stakeholders to explore joint initiatives.”

The minister noted that Turkish artists achieved global success in 2024, reaching 2.8 billion new listeners and breaking records on international charts.

“Today, more than half of royalty revenues come from audiences outside Türkiye. This strong partnership will also support young talents and female artists, giving new momentum to our cultural diplomacy,” he added.

“We will continue working closely with the Spotify team on this and similar efforts to promote Türkiye’s rich musical heritage and culture worldwide.”

Spotify, which launched in Türkiye in 2013, says it paid over TL 2 billion (nearly $50 million) to the local music industry in 2024, calling its service “pivotal in growing Turkish artists’ royalties globally.”

Economy

Türkiye’s untapped $3.5T mining potential seen as key to narrowing trade gap

The mining sector carries strategic importance and could be seen as key to narrowing the trade deficit of Türkiye, which is yet to fully utilize its massive underground potential, according to industry representatives.

Türkiye recorded a foreign trade gap of $49.3 billion (TL 2.02 trillion) in the first half of the year, of which $20.8 billion stemmed from the mining and quarrying industry, according to data from the Turkish Miners Association (TMD).

“Türkiye’s underground potential is worth $3.5 trillion. It is unacceptable to run an annual trade deficit of $50 billion-$60 billion while leaving this potential untapped,” TMD President Mehmet Yılmaz said.

Although exploration licenses cover 7.7 million hectares across the country’s 78.3 million-hectare land area, actual operating licenses represent just one-thousandth of that total. On average, only one in every 200 exploration permits becomes an active mine.

Mining activity in forest areas accounts for only 0.1% of Türkiye’s total surface area, with rehabilitation and reforestation mandated by law. So far, around 11,325 hectares have been rehabilitated.

Yılmaz says mining should be a “locomotive sector” for Türkiye’s economy, citing developed countries such as the United States, Canada, Australia, Russia, China and India, where he says mining has historically played a central role in industrial development.

“Considering our underground potential, activating the mining sector is an inevitable and highly significant reality,” he noted.

Gold, boron, marble

Yılmaz underlined Türkiye’s global significance in several key resources, including gold, boron and marble.

The country holds 73% of the world’s boron reserves, though value-added production remains limited.

Exporting refined boron products to industries such as glass, fertilizer, batteries and defense could generate an additional $2 billion annually, said Yılmaz.

In marble, he said boosting sales of processed products rather than raw exports could add $1.5 billion in revenue.

“We are the world leader in boron. And we have branded products in the marble sector,” he added.

Türkiye’s gold reserves are estimated at about 5,000 tons, but could rise toward 10,000 tons with updated surveys, according to Yılmaz.

Critical role in green transition

Yılmaz also pointed to the role of critical minerals in the global energy transition.

“Lithium, graphite and rare earth elements are vital for producing electric vehicles, wind turbines and solar panels. The shift to green energy will require six to nine times more mining. We must mobilize this potential,” he said.

He noted that Türkiye has “strategic” reserves of lithium, silver, titanium, iron, manganese, zinc, copper and aluminum, which are resources crucial for defense, renewable energy and high-tech industries.

Emphasizing the rising demand for minerals driven by clean energy technologies, Yılmaz said: “An electric vehicle requires six times more minerals than a conventional car, while an offshore wind turbine uses 13 times more minerals compared to a natural gas power plant.”

He added that Türkiye’s target of adding 60 gigawatts of renewable energy capacity by 2035 will significantly increase demand for mining inputs.

Yılmaz emphasized that industrial dependence on foreign sources is “unacceptable.”

“Positioning mining against the environment and local communities is wrong. Any mining activity that prioritizes people and the environment within a framework of sustainability should be supported,” he said.

Addressing debates over mining in olive groves, Yılmaz said activities could proceed if international criteria and safeguards are met. “Olive trees are sacred, but just like industrial plants, housing projects, or highways can cause damage, mining too can be managed in a way that balances national interest,” he added.

He also highlighted misconceptions about mining in forest areas, noting that only 0.038% of forest land is used for mining. “Preventing the misuse of such misperceptions is in the nation’s best interest,” he said.

Economy

Türkiye says to surpass $390B in goods, services trade by year-end

Türkiye is on track to achieve a new peak and exceed $390 billion (TL 15.95 trillion) in total foreign trade in goods and services this year, Trade Minister Ömer Bolat said on Tuesday.

That would mark a major upgrade from $375 billion in 2024 and compares to only $50 billion more than two decades ago, Bolat told an event in Istanbul.

Since the beginning of the year, Türkiye has added $1 billion to its exports every month, said the minister, adding that outbound shipments rose by 5.1% in the first seven months of this year.

“In 2002, Türkiye had $50 billion in exports. Today, we’ve reached $375 billion, and by year-end, we’ll surpass $390 billion,” Bolat noted.

He underlined the growing role of textiles and apparel, noting that in 2024 the sector generated $32.1 billion in exports.

Of this, $19.7 billion came from ready-to-wear and apparel, $9.4 billion from textiles and raw materials and $2.9 billion from carpets.

Together, these industries secured a 3.5% share of global exports, ranking Türkiye seventh worldwide and the European Union’s fourth-largest supplier, Bolat said.

Overall, Bolat cited the national income that reached $1.3 trillion last year and noted the economy’s continuous growth despite global challenges.

The government aims to lift the per capita income to $16,500-$17,000, the minister added. The income reached over $15,460 last year, according to official data.

“We will overcome challenges. As inflation declines, growth will accelerate in a stable environment.”

He predicted easing inflation in the period ahead would support financing conditions.

Inflation slowed to 33.5% in July, according to official data, the lowest rate since November 2021, having peaked at 75% in May last year.

Bolat said inflation has been declining for the past 14 months and said it would drop below 30% by the end of the year.

This, he said, along with declining interest rates, will make financing more accessible and support stronger export performance.

“With inflation falling into the 20s in 2026, access to financing will be easier and market stability will be firmly established,” he noted.

As disinflation continues, the Turkish central bank last month relaunched an easing cycle that was disrupted by political turmoil earlier this year, cutting its key policy rate by 300 basis points to 43%.

The bank had hiked the one-week repo rate to 46% from 42.5% in April and lifted its overnight lending rates to 49 % following market volatility over the arrest in March of Istanbul Mayor Ekrem Imamoğlu.

Imamoğlu was jailed pending trial over graft charges.

Before April, the bank had gradually cut its key policy rate from December as inflation eased.

“If global demand improves and the Russia-Ukraine war ends with a peace deal, we will see much brighter days for our economy,” said Bolat.

The minister highlighted government support for exporters, saying 60% of the ministry’s budget is allocated to incentives, including market access, trade fairs and sectoral trade delegations.

-

Sports3 days ago

Sports3 days agoChimaev warns rivals with dominating UFC title win over du Plessis

-

Sports3 days ago

Sports3 days agoHolders Barca open La Liga title defense in style against Mallorca

-

Sports2 days ago

Sports2 days agoPSG win to open Ligue 1 campaign, Espanyol stun Atleti in La Liga

-

Politics3 days ago

Politics3 days ago‘Terror-free Türkiye aims to build shared future with entire society’

-

Economy2 days ago

Economy2 days agoTürkiye’s housing market sees lowest price increase in year

-

Daily Agenda2 days ago

Daily Agenda2 days agoModel satellite of young people opened the doors of space

-

Politics3 days ago

Politics3 days agoErdoğan urges world to stop ‘humanitarian collapse’ in Gaza

-

Sports2 days ago

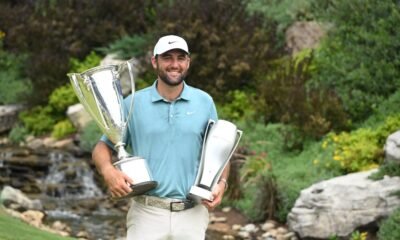

Sports2 days agoScheffler rallies to win 5th PGA Tour of year at BMW Championship