Economy

Russian govt, central bank spar over ‘painful’ economic downturn

Russian officials engaged in a public dispute on Friday over strategies to stimulate the economy, amid a slowdown more than three years into the country’s military campaign in Ukraine.

Moscow had shown unexpected economic resilience in 2023 and 2024, despite the West’s sweeping sanctions after the Kremlin sent troops into Ukraine in February 2022, with massive state spending on the military powering a robust expansion.

High defense spending has propelled growth and kept unemployment low despite fueling inflation. At the same time, wages have gone up to keep pace with inflation, leaving many workers better off.

But economists have long warned that heavy public investment in the defense industry is no longer enough to keep Russia’s economy growing.

Businesses and some government figures have urged the central bank to further cut interest rates to stimulate activity.

“The indicators show the need to reduce rates,” Deputy Prime Minister Alexander Novak said at the St. Petersburg International Economic Forum, Russia’s flagship economic forum in the country’s second-largest city.

“We must move from a controlled cooling to a warming of the economy,” said Novak, who oversees Russia’s key energy portfolio in the government.

He described the current economic situation facing the country as “painful.”

The call for more cuts to borrowing costs comes a day after Moscow’s economy minister warned the country was “on the verge of a recession.”

“A simple and quick cut in the key rate is unlikely to change anything much at the moment, except for… an increase in the price level,” the central bank’s monetary policy department chief Andrey Gangan said.

The central bank lowered interest rates from a two-decade high earlier this month, its first cut since September 2022.

The bank, which reduced the rate from 21% to 20%, said at the time that Russia’s rapid inflation was starting to come under control but monetary policy would “remain tight for a long period.”

The central bank has resisted pressure for further cuts, pointing to inflation of around 10%, more than double its 4% target.

Russia’s gross domestic product (GDP) growth slowed to 1.4% year-over-year in the first quarter, the lowest quarterly figure in two years.

Russian President Vladimir Putin, who has typically been content to let his officials argue publicly over some areas of economic policy, is set to speak on Friday afternoon at the plenary session of the economic forum.

On brink of recession

Large recruiting bonuses for military enlistees and death benefits for those killed in Ukraine have put more income into the country’s poorer regions. But over the long term, inflation and a lack of foreign investments remain threats to the economy, leaving a question mark over how long the militarized economy can keep going.

Economy Minister Maxim Reshetnikov on Thursday warned Russia’s economy is on the verge and whether the country would slide into a recession or not depends on monetary policy decisions.

“The numbers indicate cooling, but all our numbers are (like) a rearview mirror. Judging by the way businesses currently feel and the indicators, we are already, it seems to me, on the brink of going into a recession,” Reshetnikov said.

Economists have warned of mounting pressure on the economy and the likelihood it would stagnate due to lack of investment in sectors other than the military.

“Going forward, it all depends on our decisions,” Reshetnikov told a forum session, according to Russian business news outlet RBC.

In addition to keeping faith in Russia’s 4% inflation target, Reshetnikov said he was in favor of “giving the economy some love,” addressing Central Bank Governor Elvira Nabiullina, who was on the same panel.

At Thursday’s session, Nabiullina and Russia’s Finance Minister Anton Siluanov gave more optimistic assessments.

Nabiullina said the current slowdown in GDP growth was “a way out of overheating.”

Siluanov spoke about the economy “cooling” but noted that after any cooling “the summer always comes.”

Economy

Trump team reportedly favors Christopher Waller as Fed chair pick

Federal Reserve (Fed) Governor Christopher Waller is emerging as a top candidate to be the U.S. central bank’s next chair, a report said on Thursday, citing people familiar with the matter.

Waller has met with members of President Donald Trump’s team, who are impressed with him, though he has not met with the president, Bloomberg News reported. A Fed spokesperson had no comment.

“President Trump will continue to nominate the most competent and experienced individuals to deliver on his pledge to Make America Wealthy Again,” White House spokesperson Kush Desai said.

“Unless it comes from President Trump himself, however, any discussion about personnel decisions should be regarded as pure speculation.”

Trump has repeatedly criticized Fed Chair Jerome Powell for not cutting interest rates, and while he has backed off threats to try to oust Powell before his term ends on May 15, has accelerated the search for a replacement.

Trump’s pick will be closely scrutinized for a perceived ability to carry out monetary policy without ceding to political pressure, a quality that economists say is the bedrock of any central bank’s inflation-fighting capabilities and what underpins the financial stability of the U.S. economy.

Powell has not said if he would break with tradition and stay on as Fed governor after his chair term ends, though analysts speculate that if he felt the Fed’s independence was under threat, he would do so to deny Trump the chance to fill another open Fed seat.

Waller, a PhD economist whose first speech after becoming Fed governor was about the central bank’s independence, could allay those concerns.

Waller wanted an interest-rate cut at the Fed’s July meeting, and dissented along with fellow Trump appointee Fed Vice Chair Michelle Bowman when the majority decided to leave short-term borrowing costs unchanged.

While Trump has called for lower rates in order to reduce the cost of government borrowing, Waller has built his case for lower rates on the argument that tariffs won’t boost inflation and that a slowing labor market needs the support of easier policy.

He has rejected the idea that rate-setting should have anything to do with making financing cheaper for the U.S. Treasury.

White House economic advisor Kevin Hassett and former Fed Governor Kevin Warsh, both of whom have also expressed support for cutting interest rates, remain under consideration for the Fed chair job as well, Bloomberg News said.

Trump on Wednesday said both men and an unnamed third person are candidates to fill a soon-to-be-open seat on the Fed board vacated by Governor Adriana Kugler, whose unexpired term runs through January.

Economy

Chinese shippers defy tensions as exports top expectations in July

China’s exports exceeded forecasts in July, as manufacturers capitalized on a fragile tariff truce between Beijing and Washington to ship goods, particularly to Southeast Asia, ahead of tougher U.S. duties targeting transshipment.

Global traders and investors are waiting to see whether the world’s two largest economies can agree on a durable trade deal by Aug. 12 or if global supply chains will again be upended by the return of import levies exceeding 100%.

U.S. President Donald Trump is pursuing further tariffs, including a 40% duty on goods rerouted to the U.S. via transit hubs that took effect on Thursday, as well as a 100% levy on chips and pharmaceutical products and an additional 25% tax on goods from countries that buy Russian oil.

China’s exports rose 7.2% year-on-year in July, customs data showed on Thursday, beating a forecast 5.4% increase in a Reuters poll and accelerating from June’s 5.8% growth.

Imports grew 4.1%, defying economists’ expectations for a 1.0% fall and climbing from a 1.1% rise in June.

China’s trade war truce with the U.S. – the world’s largest consumer market – ends next week, although Trump hinted that further tariffs may be imposed on Beijing due to its continued purchases of Russian hydrocarbons.

“The trade data suggests that the Southeast Asian markets play an ever more important role in U.S.-China trade,” said Xu Tianchen, senior economist at The Economist Intelligence Unit.

“I have no doubt Trump’s transshipment tariffs are aimed at China, since it was already an issue during Trump 1.0. China is the only country for which transshipment makes sense, because it still enjoys a production cost advantage and is still subject to materially higher U.S. tariffs than other countries,” he added.

China’s exports to the U.S. fell 21.67% last month compared to the same period a year earlier, according to the data, while shipments to the Association of Southeast Asian Nations (ASEAN) rose 16.59% over the same period.

The levies are bad news for many U.S. trading partners, including the emerging markets in China’s periphery that have been buying raw materials and components from the regional giant and furnishing them into finished products as they seek to move up the value chain.

China’s July trade surplus narrowed to $98.24 billion from $114.77 billion in June. Separate U.S. data released on Tuesday showed that the trade deficit with China shrank to its lowest level in more than 21 years in June.

Despite the tariffs, markets showed optimism for a breakthrough between the two superpowers, with China and Hong Kong stocks rising in morning trade. Trump indicated earlier this week that he might meet Chinese President Xi Jinping later this year if a trade deal was reached.

Trade uncertainty

China’s commodities imports painted a mixed picture, with soybean purchases hitting record highs in July, driven by bulk buying from Brazil while avoiding U.S. cargoes. Analysts, however, cautioned that inventory building may have skewed the import figures, masking weaker underlying domestic demand.

“While import growth surprised on the upside in July, this may reflect inventory building for certain commodities,” said Zichun Huang, China economist at Capital Economics, pointing to similarly strong purchases of crude oil and copper.

“There was less improvement in imports of other products and shipments of iron ore continued to cool, likely reflecting the ongoing loss of momentum in the construction sector,” she added.

A protracted slowdown in China’s property sector continues to weigh on construction and broader domestic demand, as real estate remains a key store of household wealth.

Chinese government advisers are stepping up calls to make the household sector’s contribution to broader economic growth a top priority at Beijing’s upcoming five-year policy plan, as trade tensions and deflation threaten the outlook.

Reaching an agreement with the U.S. and the European Union, which have accused China of producing and selling goods at too low a price, would give Chinese officials more room to advance their reform agenda.

However, analysts expect little relief from Western trade pressures. Export growth is projected to slow sharply in the second half of the year, hurt by persistently high tariffs, President Trump’s renewed crackdown on the rerouting of Chinese shipments and deteriorating relations with the EU.

Economy

Climate change drives up global food prices, adds to societal risks

Extreme weather patterns and events resulting from climate change are causing the prices of food products, such as coffee, cocoa and rice, to rise in various countries and regions around the world, according to a report released on Thursday, citing a recently published study.

The increase in temperature and extreme weather events, such as floods and storms, caused by climate change, also affect agricultural activities and threaten food security.

In July, scientists from various research institutes in Europe conducted a study titled “Climate extremes, food price spikes and their wider societal risks.”

In the study, which examined the impact of climate change on food prices, scientists compiled reports highlighting the rise in food prices across different countries due to climate extremes.

According to the study, agricultural products affected by climate change vary according to their geographical location.

The severe droughts experienced in Southern Europe during 2022-2023 led to a 50% increase in olive oil prices across the European Union as of January 2024. Moreover, at the beginning of 2024 in the U.K., potato prices rose by 22% due to rainy weather conditions.

In East Asia, the heat waves in 2024 led to extreme temperatures in almost all of South Korea and Japan, as well as large areas of China and India. These extreme weather events increased the price of Korean cabbage by 70% in September 2024 compared to the same month the previous year. Japanese rice also rose by 48% during the same period. Additionally, vegetable prices in China increased by 30% in June and August.

Impact on various crops

In Vietnam, after the heat wave in February 2024, robusta coffee prices doubled by July. Similarly, in Indonesia, following the drought in 2023, rice prices increased by 16%.

And in Pakistan, food prices in rural areas rose by 50% within weeks following the devastating floods in August 2022. In neighboring India, following the heat wave in May 2024, onion and potato prices surged in the second quarter of the year. During this period, onion prices increased by 89% and potato prices by 81%.

In Australia, the floods in 2022 caused lettuce prices to rise. During this period, lettuce prices increased by staggering 300%.

After the heat wave in March 2024 in South Africa, corn prices rose by 36% in April. The 2022 drought in Ethiopia also had an adverse impact on food prices. Following the drought, food prices increased by 40% in March 2023.

At the same time, back in 2022, drought in the American states of California and Arizona, which provide over 40% of the national vegetable production, severely affected vegetable production. As of November 2022, vegetable prices in the U.S. increased by 80% in one year.

Following the 2023 drought in Mexico, there was a 20% increase in fruit and vegetable prices at the beginning of the following year.

Coffee, cocoa prices

Climate extremes not only caused price increases locally but also increased the global market prices of major food commodities such as coffee and cocoa.

The 2023 drought in Brazil, the world’s largest coffee producer, led to price increases. Global coffee prices rose by 55% in August 2024.

In Ghana and Ivory Coast, which account for about 60% of global cocoa production, extreme heat in February 2024 and ongoing prolonged drought from the previous year affected global cocoa prices. Cocoa prices increased by about 300% in one year as of April 2024.

Affecting numerous crops and spreading globally, the climate-induced surge in food prices can trigger various societal risks.

Increasing food prices, particularly for low-income households, significantly affects their food security. Such households may become less resistant to diseases due to inadequate nutrition, adding additional burdens to the health care system and increasing public expenditures.

Moreover, increases in food prices lead to a rise in overall inflation, posing significant risks for developing countries where the share of food prices in inflation is high.

Economy

Consortium with Turkish firms inks $4B deal to develop Damascus Airport

A five-company consortium led by Qatar’s UCC Holding and comprising three Turkish firms signed a $4 billion deal on Wednesday with the Syrian Civil Aviation Authority to develop and expand Damascus International Airport.

The deal was one of several agreements signed in Damascus during a ceremony attended by Syrian interim President Ahmed al-Sharaa, worth $14 billion, including infrastructure, transportation and real estate projects aimed at reviving the war-damaged economy.

Turkish companies Kalyon Holding, Cengiz Holding and TAV Construction, along with UCC Holding and Assets Investments from the U.S., will be involved in redeveloping Damascus International Airport, aiming to raise its annual passenger capacity to 31 million within eight years, an Anadolu Agency (AA) report said.

The deal marks one of the largest infrastructure projects in Syria in years, despite the country’s prolonged instability following more than a decade of civil war and the wider impacts of the second year of Israel’s genocidal war on Gaza and regional conflicts.

According to a statement from Kalyon Holding, the companies involved have carried out global-scale investments in energy, infrastructure and transportation both in Türkiye and abroad.

The new airport deal follows a $7 billion strategic cooperation agreement signed last May between the Syrian Ministry of Energy and the same core consortium, including Kalyon Holding, Cengiz Holding, UCC from Qatar and Power International from the U.S.

The agreement includes a 5,000 megawatt (MW) energy project, expected to generate approximately 35 billion kilowatt-hours (kWh) annually, supplying a significant share of Syria’s electricity needs.

‘To leave a legacy’

Chairperson of the board of Kalyon Construction, Murathan Kalyoncu, said the new airport deal reflects the group’s commitment to long-term regional development.

“As a domestic and national company, we have focused on people in every region we have operated in for 81 years and aim to leave a legacy for future generations,” he said.

“We successfully completed the construction of Istanbul Airport, Türkiye’s largest infrastructure project, in a record 42 months with a consortium including Cengiz Holding. We then elevated the airport to a global leadership position as a hub with an annual passenger capacity of 90 million.”

“Now, I wholeheartedly believe that with our management experience, engineering strength, technical competence and solution-oriented approach, we will make significant contributions to Damascus’s transformation into a regional air transportation hub,” Kalyoncu added. “I hope the massive investments we have undertaken will mark a turning point for Syria and provide significant support for regional development and stability.”

Alongside the airport investment, Syria signed a series of investment memoranda worth $14 billion on Wednesday, covering 12 strategic projects with several foreign firms.

Talal al-Hilali, director of the Syrian Investment Authority, said the agreements include a $4 billion deal with Qatar’s UCC Holding for the Damascus International Airport project, a $2 billion agreement with the UAE’s national investment corporation to build a metro line in Damascus, and a $2 billion contract with Italy-based UBAKO to develop Damascus Towers.

In July, Syria also signed $6.4 billion of investments with Saudi Arabia as it seeks to rebuild after years of civil war.

Economy

Slovenia bans imports from illegal Israeli settlements over Gaza crisis

The Slovenian government announced on Wednesday a ban on imports of goods from illegal Israeli settlements in the occupied West Bank, in a “symbolic measure” designed to ratchet up diplomatic pressure over the war in Gaza.

Slovenia’s government has frequently criticized Israel over the conflict and last year moved to recognize a Palestinian state as part of efforts to end the fighting in Gaza as soon as possible.

“The actions of the Israeli government … constitute serious and repeated violations of international humanitarian law,” the government said in a statement on Wednesday.

Slovenia “cannot and must not be part of a chain that enables or overlooks” such violations, it said, including the “construction of illegal settlements, expropriations, the forced evictions of the Palestinian population.”

The Slovenian government thus decided to “ban imports of goods originating from Israeli illegal settlements.”

Its latest move represents a “clear reaction to the Israeli government’s policy, which … undermines the possibilities for lasting peace and a two-state solution.”

“While symbolic,” the ban “is a necessary response to the ongoing humanitarian and security situation in Gaza,” Slovenia’s Foreign Minister Tanja Fajon said of the measure.

The government said that it was also examining a ban on exports of goods from Slovenia “destined for (the) illegal settlements,” saying that it would then “decide on further measures.”

According to the STA news agency, citing a government statement from January, Slovenia did not import any goods from Israeli settlements in 2022 and 2024, respectively.

In 2023, imports amounted to some 2,000 euros.

Early in July, Slovenia was the first EU country to ban two far-right Israeli ministers from entering the country.

It declared both Israelis “persona non grata,” accusing them of inciting “extreme violence and serious violations of the human rights of Palestinians” with “their genocidal statements.”

In June 2024, Slovenia’s parliament passed a decree recognizing Palestinian statehood, following in the steps of Ireland, Norway and Spain.

Economy

BoE cuts its main interest rate to 4%, lowest since early 2023

The Bank of England (BoE) lowered its main interest rate by a quarter percentage point to 4% on Thursday, as policymakers seek to bolster the sluggish U.K. economy.

Thursday’s decision was widely anticipated in financial markets as the bank’s Monetary Policy Committee (MPC) balances its responsibility to control inflation against concern that rising taxes and U.S. President Donald Trump’s global trade war may slow economic growth.

The committee voted 5-4 in favor of the cut.

The rate cut is the bank’s fifth since last August, when policymakers began lowering borrowing costs from a 16-year high of 5.25%. The Bank of England’s key rate – a benchmark for mortgages as well as consumer and business loans – is now at the lowest level since March 2023.

“There will be hopes that if loans become cheaper, it will help boost consumer and business confidence but there’s a long way to go,” Susannah Streeter, head of money and markets at Hargreaves Lansdown, said before the decision.

“In the meantime, speculation over potential tax rises in the Autumn Budget may keep households and companies cautious, given the uncertainty over where extra burdens may land.”

Policymakers decided to cut rates even though consumer prices rose 3.6% in the 12 months through June, significantly above the bank’s 2% target. The bank sees the recent rise in consumer prices as a temporary spike, due in part to high energy costs, and expects inflation to fall back to the target next year.

Against the backdrop, policymakers were faced with reports that the government may be forced to raise taxes later this year due to sluggish economic growth, rising borrowing costs and pressure to increase spending.

Britain’s unemployment rate rose to 4.7% in the three months through May, the highest level in four years, signaling that previous tax increases and uncertainty about the global economy are weighing on employers.

The U.K. economy grew 0.7% in the first three months of 2025 after stagnating in the second half of last year.

-

Politics2 days ago

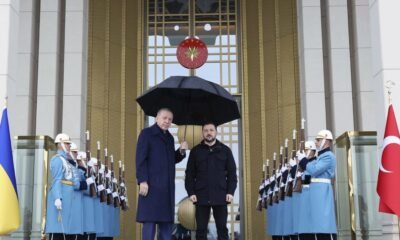

Politics2 days agoErdoğan to visit Ukraine, free trade on agenda: Envoy

-

Daily Agenda3 days ago

Daily Agenda3 days agoHalf of us and hearts are comfortable nests peaceful

-

Sports2 days ago

Sports2 days agoBengisu Avcı makes Turkish sports history by conquering Ocean’s 7

-

Economy2 days ago

Economy2 days agoArgentina’s Milei vetoes pension, disability spending hikes

-

Daily Agenda2 days ago

Daily Agenda2 days agoThe Chief of General Staff changed with the age decision

-

Daily Agenda3 days ago

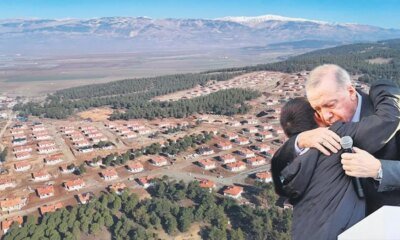

Daily Agenda3 days agoBrand new Kahramanmaraş with the power of the state in 2.5 years

-

Economy24 hours ago

Economy24 hours agoPublic land formula essential for transformation

-

Refugees2 days ago

Refugees2 days agoTurkish parliamentary committee begins work on PKK peace initiative