Economy

Turkish firm to invest $520M in solar equipment production

Turkish solar technology company CW Enerji will invest $520 million (TL 21.09 billion) under the government’s HIT-30 incentive program to expand its high-efficiency solar panel manufacturing capacity in the Antalya Organized Industrial Zone, according to a recent report by Anadolu Agency (AA).

The company currently produces high-efficiency TOPCon solar cells at its CW Solar Cell facility in the southwestern coastal city of Antalya, with an annual capacity of 1.2 gigawatts (GW).

The facility is the largest of its kind in Türkiye and Europe. With the new investment, CW Enerji aims to boost capacity to 5 GW by 2028 as part of the project’s second phase.

The factory manufactures high-tech solar panels from ingot raw materials and sources over 80% of its components domestically.

CW Enerji Chairperson Tarik Sarvan emphasized the strategic importance of local supply chains in a recent interview with AA.

“We will source the gases and chemicals needed in production from within Türkiye,” said Sarvan. “This will protect local producers and help build a healthy ecosystem.”

Sarvan founded the company in 2010, having gained experience in Europe’s solar energy sector.

Under the HIT-30 program, which aims to establish Türkiye as a global high-tech manufacturing hub by 2030, CW Enerji is supporting national solar energy goals.

“We will produce solar panels in line with Türkiye’s VAT incentive regulations and with more than 80% domestic content,” Sarvan said. “This investment will also create specialized jobs for chemists, energy system engineers and physicists.”

The company has already launched a 35-45 megawatt production line at its new facility and has expanded into related technologies, including EVA, aluminum, glass and junction boxes.

The company is also producing aluminum components specifically for solar plants and previously benefited from Türkiye’s 5th Region incentives.

As global solar cell prices decline due to shifting production in China and the U.S., Sarvan sees an opportunity for Türkiye’s industrial base.

“We’ve established firms in Munich and Houston to supply country-specific solar panels,” he said. “Currently, we have 1.8 GW of panel production capacity, with 90% sold domestically.”

CW Enerji exports to nearly 60 countries and is active in all stages of the solar value chain, from manufacturing to wholesale and EPC (engineering, procurement, and construction) services.

Its panels are used in industrial rooftops, agricultural irrigation systems, marine applications and smart home systems.

“With a current capacity of 1.2 GW, our facility remains the largest producer of TOPCon High Efficiency cells in Türkiye and Europe,” Sarvan said.

“We’re expanding over an area of 200,000 square meters to reach 5 GW of total capacity, targeting both U.S. and European markets,” he concluded.

Economy

Turkish economy reenters ‘positive cycle,’ receives rating upgrade

The Turkish economy has reentered a “positive cycle,” overcoming the period of domestic and international uncertainties and difficulties, a top official said on Saturday, reiterating the aim to lower inflation.

“Our country’s credit rating has been upgraded. Our economy has overcome a period of domestic and international uncertainties and challenges, reentering a positive cycle,” Treasury and Finance Minister Mehmet Şimşek said in a post on X, referring to the latest upgrade of Türkiye’s rating by Moody’s.

Moody’s raised Türkiye’s long-term debt rating one notch, from “B1” to “Ba3,” with a “stable” outlook, the credit rating agency said on Friday.

Moody’s justified its decision by citing effective economic policies that have helped restore investor confidence in the Turkish lira.

It also highlighted the central bank’s commitment to the tight monetary policy that “durably eases inflationary pressures” and “reduces economic imbalances.”

“This rating increase confirms our successful management of the process and the resilience of our economy,” Şimşek further said.

“We are determined to permanently reduce inflation, maintain the current account deficit at a sustainable level, and strengthen budget discipline, excluding earthquake-related expenditures,” he added.

In a televised interview on Sunday, Şimşek reiterated his statement about returning to the “positive cycle,” citing the recovery in reserves since March.

“Our reserves were over $170 billion in mid-March and have now returned to that level. Therefore, we are back to the levels we were before these shocks began,” he noted.

“Our CDSs were around 256, reached 300, and now they are around 280 again,” he added. At the same time, he also pointed out that financial conditions have now eased, noting that growth continues at a moderate pace and that they have not experienced a significant deterioration in the current account deficit.

Regarding inflation goals, he recalled that the year-end inflation forecast is between 24% and 29%.

“We anticipate a midpoint between those figures. The core of our program is to combat the cost of living. That is, to permanently reduce inflation and increase our citizens’ purchasing power,” he said.

The annual inflation rate in Türkiye eased to 35.05% in June, slowing down significantly from around 75% in May 2024, according to official data.

The minister also said on X on Saturday that they aim to make “the gains of our program permanent through reforms that will drive structural transformation in industry, particularly in green and digital transformation.”

“As we continue to implement our program with patience and determination, our risk premium will further decrease, access to financing will increase and new rating upgrades will follow,” Şimşek said.

The Turkish government has been implementing an economic program with the main aim of lowering inflation to single digits, while also focusing on issues such as green and digital transformation, tax evasion and reducing the budget and current account deficits.

The Turkish central bank cut its key interest rate from 46% to 43% on Thursday, a slightly larger-than-expected reduction.

The institution began a series of rate cuts in December as inflation slowed, but on Thursday, it predicted a temporary rebound in monthly inflation in July.

In the longer-term, it expects inflation to ease to 24% by the end of this year and 12% by the end of 2026.

Apart from Moody’s, Fitch Ratings also affirmed the country’s rating at “BB-” on Friday, maintaining a “stable” outlook.

Economy

German minister draws ire after calling for longer working hours

Germans need to work longer and more, Economy Minister Katherina Reiche has told a paper in remarks published on Saturday, spurring immediate criticism from worker representatives.

“Demographic change and increasing life expectancy make this unavoidable. Lifetime working must rise,” she said.

Working for just two-thirds of adult life and going on a pension for a third was not possible over the longer term. Too many people had denied demographic reality for too long, Reiche said.

“We have to work harder and longer,” she said. While many were working in physically arduous jobs, there were also many who could and wanted to work for longer.

Reiche noted that companies were reporting that employees worked 1,800 hours per year in the U.S. and only 1,340 in Germany.

She said that reforms agreed by the new center-left government in its coalition deal would not suffice over the longer term.

“Social security systems are overloaded. The combination of nonwage labor costs, taxes and deductions are making the labor factor in Germany uncompetitive over the longer term,” Reiche said.

Christian Baumler, who heads the workers association within Reiche’s own Christian Democrats, expressed criticism of the minister’s remarks and noted that they had no basis in the coalition deal with Social Democrats.

“An economy minister who does not realize that Germany has a high part-time working ratio, and thus a low average annual working time, is the wrong choice for the position,” he said.

The German Trade Union Confederation (DGB) also warned against raising the retirement age. “To ensure good pensions, more money must now come in on the income side of the pension insurance system,” said DGB board member Anja Piel.

Tasks that benefit society as a whole, such as pensions for mothers, must be paid for out of tax revenue and not out of the pension fund, she said.

Economy

Fed expected to hold off on rate cuts again despite Trump pressure

The U.S. central bank is widely expected to hold off cutting interest rates again at its upcoming meeting, as officials gather under the cloud of a mounting pressure campaign by President Donald Trump.

Policymakers at the independent Federal Reserve (Fed) have kept the benchmark lending rate steady since the start of the year as they monitor the impact of Trump’s sweeping tariffs on the world’s largest economy.

With Trump’s on-again, off-again tariff approach – and the lagged effects of the levies on inflation – Fed officials want to see economic data from this summer to gauge how prices are being affected.

When mulling changes to interest rates, the central bank – which meets on Tuesday and Wednesday – seeks a balance between reining in inflation and the health of the jobs market.

But the bank’s data-dependent approach has enraged the Republican president, who has repeatedly criticized Fed Chair Jerome Powell for not slashing rates further, calling him a “numbskull” and “moron.”

Most recently, Trump signaled he could use the Fed’s $2.5 billion renovation project as an avenue to oust Powell, before backing off and saying that would be unlikely.

Trump visited the Fed construction site on Thursday, making a tense appearance with Powell in which the Fed chair disputed Trump’s characterization of the total cost of the refurbishment in front of the cameras.

But economists expect the Fed to look past the political pressure at its policy meeting.

“We’re just now beginning to see the evidence of tariffs’ impact on inflation,” said Ryan Sweet, chief U.S. economist at Oxford Economics.

“We’re going to see it (too) in July and August, and we think that’s going to give the Fed reason to remain on the sidelines,” he told Agence France-Presse (AFP).

‘Trial balloon’

Since returning to the presidency in January, Trump has imposed a 10% tariff on goods from almost all countries, as well as steeper rates on steel, aluminum and autos.

The effect on inflation has so far been limited, prompting the U.S. leader to use this as grounds for calling for interest rates to be lowered by three percentage points.

Currently, the benchmark lending rate stands at a range between 4.25% and 4.50%.

Trump also argues that lower rates would save the government money on interest payments and floated the idea of firing Powell.

The comments roiled financial markets.

“Powell can see that the administration floated this trial balloon” of ousting him before walking it back on the market’s reaction, Sweet said.

“It showed that markets value an independent central bank,” the Oxford Economics analyst added, anticipating, Powell, will be instead, more influenced by labor market concerns.

Powell’s term as Fed chair ends in May 2026.

Jobs market ‘fissures’

Analysts expect to see a couple of members break ranks if the Fed’s rate-setting committee decides for a fifth straight meeting to keep interest rates unchanged.

Sweet cautioned that some observers may spin dissents as pushback on Powell, but argued that this is not necessarily the case.

“It’s not out of line or unusual to see, at times when there’s a high degree of uncertainty, or maybe a turning point in policy, that you get one or two people dissenting,” said Nationwide chief economist Kathy Bostjancic.

Fed Governor Christopher Waller and Vice Chair for Supervision Michelle Bowman have both signaled openness to rate cuts as early as July, meaning their disagreement with a decision to hold rates steady would not surprise markets.

Bostjancic said that too many dissents could be “eyebrow-raising” and lead some to question if Powell is losing control of the board, but added: “I don’t anticipate that to be the case.”

For Sweet, “the big wild card is the labor market.”

There has been weakness in the private sector, with hiring rates below average and the number of permanent job losers increasing.

“There are some fissures in the labor market, but they haven’t turned into fault lines yet,” Sweet said.

If the labor market suddenly weakened, he said he would expect the Fed to start cutting interest rates sooner.

Economy

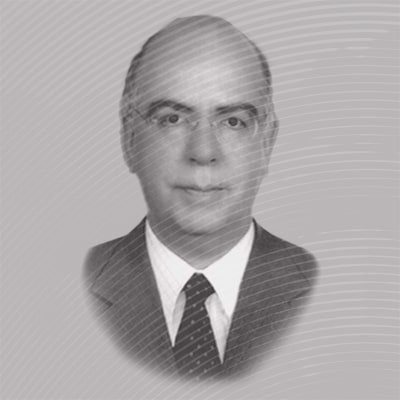

Ex-Turkish central bank governor Süreyya Serdengeçti passes away at 73

Former Turkish central bank chief Süreyya Serdengeçti passed away on Saturday at the age of 73, local media reports said.

Serdengeçti, who served as the head of the Central Bank of the Republic of Türkiye (CBRT) from 2001 to 2006, is credited with lowering inflation to single digits during his tenure, which followed the 2001 economic crisis.

Within the same period, in 2005, Türkiye also transitioned to the new currency by dropping six zeros from the previous “old lira.”

Serdengeçti was born in Istanbul in 1952 and graduated from the Middle East Technical University in 1979 with a bachelor’s degree in economics. Later on, between 1984 and 1986, he studied in the U.S., where he earned a master’s degree in economics at Vanderbilt University.

In 1980, he began working in the Foreign Debt Repayment Department of the CBRT, and from 1982 onward, he served in the Foreign Exchange Operations Department. Upon his return to Türkiye, he continued to manage foreign exchange reserves at the central bank.

He held several other positions before being appointed as the governor of the central bank in March 2001 by then-State Minister for the Economy, Kemal Derviş.

“We have learned with sadness of the passing of Mr. Süreyya Serdengeçti, who served as the Governor of the Central Bank between 2001 and 2006. We extend our condolences to his family and all his loved ones, and pray for God’s mercy upon him,” the CBRT said in a statement on X on Saturday.

Economy

Trump, EU chief meet aiming for trade deal after long standoff

U.S. President Donald Trump and EU chief Ursula von der Leyen are expected to come together on Sunday in Scotland in a decisive push to resolve a months-long transatlantic trade standoff.

The clock is ticking with Trump vowing to hit dozens of countries with punitive tariffs unless they hammer out a pact with Washington by Aug. 1, with the EU facing an across-the-board levy of 30%.

Von der Leyen’s European Commission, negotiating on behalf of the EU’s 27 countries, has been pushing hard for a deal to salvage a trading relationship worth an annual 1.6 trillion euros ($1.9 trillion) in goods and services.

Brussels has coordinated closely with European capitals, whose diplomats are expected to meet swiftly to give their blessing to any deal struck at the leader level, if indeed Trump and von der Leyen see eye to eye.

Sunday’s sit-down will take place at 4:30 p.m. local time (15:30 GMT) in Turnberry, on Scotland’s southwestern coast – where Trump owns a luxury golf resort.

The 79-year-old said on arrival Friday he hoped to strike “the biggest deal of them all” with the EU.

Referring to von der Leyen simply as “Ursula,” Trump praised her as “a highly respected woman” – a far cry from his erstwhile hostility in accusing the EU of existing to “screw” the U.S.

Deal ‘in reach’

“I think we have a good 50-50 chance” of a deal, said the president – citing sticking points on “maybe 20 different things.”

The European Commission said Thursday it believed a deal was “in reach.”

According to European diplomats, the agreement on the table involves a baseline 15% levy on EU exports to the U.S. – the same level secured by Japan – with carve-outs for critical sectors including aircraft, lumber and spirits, excluding wine.

The EU would also commit to ramp up purchases of U.S. liquefied natural gas (LNG), as one of a series of investment pledges.

The European side was also hoping for a compromise on steel that could allow a certain quota to enter the U.S., with amounts beyond that taxed at 50%.

Hit by multiple waves of tariffs since Trump reclaimed the White House, the EU is currently subject to a 25% levy on cars, 50% on steel and aluminum, and an across-the-board tariff of 10%, which Washington threatens to hike to 30% in a no-deal scenario.

The EU has focused on getting a deal with Washington to avoid sweeping tariffs from further harming its sluggish economy, with retaliation held out as a last resort.

Should talks fail, EU states have greenlit counter tariffs on $109 billion (93 billion euros) of U.S. goods, including aircraft and cars – to take effect in stages from Aug. 7 – and Brussels is also drawing up a list of U.S. services to potentially target.

Beyond that, countries like France say Brussels should not be afraid to deploy a so-called trade “bazooka” to restrict access to its market and public contracts – but that would mark a major escalation with Washington.

Dealmaker credentials

Trump has embarked since returning to power on a campaign to reshape U.S. trade with the world.

But polls at home suggest the American public is unconvinced by his strategy, with a recent Gallup survey showing his approval rating at 37% – down 10 points from January.

Having promised “90 deals in 90 days,” Trump’s administration has so far unveiled five, including with U.K., Japan and the Philippines.

In addition to bolstering his dealmaker credentials, a headline agreement with the EU could bring a welcome distraction from the scandal around Jeffrey Epstein, the wealthy financier accused of sex trafficking who died in prison in 2019 before facing trial.

In his heyday, Epstein was friends with Trump and others in the New York jet-set, but the president is now facing backlash from his own MAGA supporters demanding access to the case files.

Economy

Türkiye sees exports to Africa near $10B in 1st half of 2025

Türkiye has seen its exports to Africa near $10 billion in the first half of 2025, according to the Turkish Exporters’ Assembly (TIM), with Morocco as the top recipient.

Morocco imported $1.8 billion worth of Turkish goods in January-June, leading the continent as improvements in bilateral relations and Türkiye’s proximity continued to boost trade.

Egypt followed with $1.6 billion in imports, while Libya received $1.3 billion. Other key markets included Tunisia with $554.1 million, South Africa with $303.5 million, and Nigeria with $242.3 million.

In terms of growth in value, Türkiye’s exports to Morocco increased by $345 million from the same period last year. Exports to Libya grew by $262 million, the Democratic Republic of Congo by $103 million, Niger by $91.5 million, and Ghana by $68.1 million.

Chemical products topped the list of Türkiye’s exports to the continent, totaling $1.3 billion. This was followed by cereals, grains, oilseeds and derivatives with $1.2 billion, steel with $942.4 million, textiles and raw materials with $675.5 million, and automotive products with $619 million.

-

Refugees3 days ago

Refugees3 days agoTurkey mourns 5 volunteer firefighters killed battling wildfires

-

Daily Agenda3 days ago

Daily Agenda3 days agoMinister of Justice Yılmaz Tunç: A deliberate smear campaign is being carried out

-

Daily Agenda2 days ago

Daily Agenda2 days agoThe domestic meteor missile is coming: the button was pressed for Gökbora

-

Daily Agenda2 days ago

Daily Agenda2 days agoEarthquake houses are rising rapidly – Breaking News

-

Politics2 days ago

Politics2 days agoJuly 15 association to expose coup, FETÖ facts in 54 countries

-

Economy2 days ago

Economy2 days agoMeta to ban political ads in EU over ‘unworkable’ rules

-

Daily Agenda2 days ago

Daily Agenda2 days agoCHP Beykoz District President came out of the Şile file

-

Lifestyle2 days ago

Lifestyle2 days agoPlanning Paros: Traveler’s guide to Greece’s chicest island escape