Economy

EU’s industrial divide: ‘Made in Europe’ or ‘Made with Europe’

There is broad agreement that the European Union must step in to support its struggling industries, but member states are divided on how aggressively the bloc should pursue a “Buy European” strategy to achieve that goal.

The European Commission, the EU’s executive arm, will next week propose new rules that are expected to include a requirement for companies in strategic sectors to produce in Europe if they want to receive public money.

But the definition of “European preference” has triggered debate, with calls especially from France for more “Made in Europe,” while other bloc states, such as Germany, call for “Made with Europe.”

Protecting Europe or European protectionism?

French President Emmanuel Macron insisted the new rules would be about “protecting our industry” without “being protectionist,” by defending “certain strategic sectors, such as cleantech, chemicals, steel, cars or defense.”

Otherwise, he warned, “Europeans will be swept aside.”

But other EU countries, which are proponents of free trade, oppose the plans.

Swedish Prime Minister Ulf Kristersson said Europe should compete based on quality and innovation, not because it wanted to protect European markets.

“We do not want to protect European businesses that are basically not competitive,” Kristersson told the Financial Times newspaper last week.

But EU leaders during talks on Thursday appeared to reach a consensus on the issue, pushing for the measure in certain specific sectors since they say Europe faces unfair competition from China and other countries.

“We are in favor of open markets,” German Finance Minister Lars Klingbeil said Monday. “But I also want to be very clear: if China changes the rules of the game, if we are confronted with overcapacity, subsidies, and the fact that markets in Europe are flooded, then Europe must defend itself.”

In Europe or with Europe?

Supporters want “Made in Europe” to be strictly defined, and only for industrial goods made from components manufactured in the European Economic Area, made of the EU’s 27 states as well as Iceland, Liechtenstein and Norway.

Critics say this definition would be too restrictive and instead call for a more flexible measure, like Germany’s Merz, who calls for “Made with Europe” not “Made in Europe.”

They also argue it would be difficult to apply in practice and risks destabilizing European supply chains.

“Typically, even a vehicle assembled in Europe incorporates hundreds of specialized components sourced from all over the world. Many critical inputs cannot be competitively produced at scale in Europe,” Japanese carmaker Honda said.

Britain and Türkiye, for whom the EU is an important trading partner, have also privately expressed concern to Brussels about keeping their countries out.

Some EU capitals are worried about potential retaliatory measures from supplier countries, which would drag Europe into showdowns at a moment when it needs to strengthen its exports.

What will the rules look like?

The EU executive insists it has balanced the need to be open and protect firms.

The measure will be “targeted in three ways,” said the office of EU industry chief Stephane Sejourne – who is spearheading the push.

It will affect:

A limited number of critical components A limited number of strategic sectors Only when public funding is involved.

The final proposal, which will be announced on Feb. 25, could end up only touching a handful of sectors: the auto industry and those playing an essential role in the green transition and confronted by what the EU says is unfair Chinese competition, such as solar panels, wind turbines and batteries.

Sejourne’s office insisted companies producing in the EU would be considered European and there would be “reciprocal commitments” with trusted partners.

A draft document seen by the Agence France-Presse (AFP) says products made in countries outside the EU with rules similar to the bloc will be treated like those made in Europe.

Non-EU countries, however, remain watchful until the real proposal lands.

For example, there are still many unknowns, including what the percentages of European or equivalent components will be required from manufacturers if they wish to continue accessing public money.

Economy

Turkish central bank total reserves rose about $4.3B last week: Bankers

Total reserves of the Turkish central bank are estimated to have increased by $4.3 billion (TL 188.02 billion) last week to $212 billion, driven in part by a $2 billion gain linked to higher gold prices, according to bankers.

The reserves had fallen by nearly $10.7 billion in the week ending on Feb. 6 to $207.5 billion after reaching an all-time high of around $218.2 billion in the prior week.

Three bankers consulted by Reuters calculated that net reserves of the Central Bank of the Republic of Türkiye (CBRT) increased by $5 billion to $96 billion in the week ending Feb. 13.

Bankers estimated that the increase in gold prices in the week to Feb. 13 had an upward impact of nearly $2 billion on reserves. According to the calculations, the central bank bought $2 billion from the market last week.

Gold prices fell to a more than one-week low on Tuesday, pressured by a stronger U.S. dollar as investors tracked cues on geopolitics and the Federal Reserve’s (Fed) monetary policy.

The reserve calculations are based on preliminary data from the central bank. Official data will be released on Thursday.

The CBRT, despite temporary fluctuations, has been steadily building its reserves since a shift to more conventional economic policies in the middle of 2023.

A new program last month showed the bank plans to increase its international reserves as long as market conditions allow.

Economy

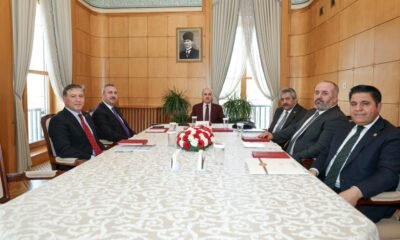

Türkiye, France after expanding co-op in contracting, energy, defense

Türkiye and France discussed strengthening partnerships in contracting services, cooperation in third countries, including Africa, as well as energy, defense and logistics, Trade Minister Ömer Bolat said on Tuesday.

Bolat’s remarks came following the Türkiye-France Joint Economic and Trade Committee (JETCO) meeting he chaired with French minister delegate for Foreign Trade and Economic Attractiveness Nicolas Forissier in Istanbul.

The sides held extensive discussions aimed at deepening Turkish-French cooperation across a broad range of sectors, the minister said.

“We held comprehensive discussions aimed at further developing the Turkish-French partnership in contracting services, joint ventures in third countries, partnerships, energy, transportation, environment, water, aviation, the defense industry and logistics sectors,” he noted.

Rising trade, investments

Bolat noted that bilateral trade between Türkiye and France rose sharply to $24.1 billion in 2025 from $14 billion in 2020, emphasizing that the trade structure remains balanced between the two countries.

He added that France’s total investments in Türkiye have reached $8.7 billion, of which $4 billion came in the past four years, while officials are currently evaluating a pipeline of roughly $5 billion in additional French investment projects over the next three years.

Bolat said the expanding commercial and economic ties between the two countries have gained “strong momentum” with the eighth JETCO meeting and reaffirmed Ankara’s commitment to further strengthening cooperation. The next JETCO meeting is expected to be held in France in June, he added.

Cooperation in 3rd countries

The minister emphasized that bilateral cooperation increasingly extends beyond national borders, particularly in Africa, Eastern Europe, Central Asia and the Middle East, where he says Turkish and French companies aim to pursue joint projects.

Both governments reaffirmed their readiness to support partnerships in these regions, encouraging firms to collaborate on infrastructure, energy and development initiatives, he said.

Existing cooperation spans automotive, aviation, pharmaceuticals, renewable energy, textiles, food, cement, construction, information and communication technologies, tourism, finance and insurance, Bolat said, emphasizing that they believe these will develop further and that new investments are being discussed.

In logistics, improved connectivity through air, land and sea routes, including the Ro-Ro line between Sete Port in southern France and Yalova in northwestern Türkiye, has helped facilitate trade flows and strengthen commercial links.

Bolat said Turkish logistics companies’ growing presence in southern French ports is also contributing to deeper integration.

EU ties, visa facilitation

Bolat said he and Forissier also discussed broader Türkiye-EU relations, including progress toward resolving technical issues regarding the customs union.

The EU-Türkiye Customs Union entered into force in 1995, but is limited to industrial goods and processed agricultural products. Türkiye and the business world have repeatedly called for talks to modernize the deal to restart, but no concrete steps have been taken.

Türkiye has been an official candidate to join the EU since 1999, but its accession has been frozen for years over multiple disagreements. The sides have in recent months shown signs of increased engagement and economic cooperation.

Bolat said France had issued 163,000 visas to Turkish citizens last year, its second-highest worldwide after China, and officials noted that waiting times have declined and procedures have been eased, particularly for students and businesspeople.

“We reaffirmed that we will work together for the days when visas will be lifted,” said the minister.

Economy

Warner Bros. gives Paramount 7 days to set ‘best and final’ offer

Warner Bros. Discovery said Tuesday it has reopened talks with Paramount Skydance on its buyout offer, giving the company seven days to come up with a “best and final” offer for the owner of HBO Max and the “Harry Potter” franchise, after earlier turning down the hostile bid.

Paramount has until Feb. 23 to make a new offer, which Netflix is allowed to match under the terms of the merger agreement, Warner Bros. said.

Television and film titan Warner Bros. Discovery, which owns CNN, announced in late October that it was open to acquisition offers. Its board subsequently accepted a bid from Netflix to buy only its streaming and studio business.

Paramount Skydance is seeking to buy all of Warner Bros. Discovery for some $108 billion. Netflix is offering nearly $83 billion for its more limited merger.

“Our Board has not determined that your proposal is reasonably likely to result in a transaction that is superior to the Netflix merger,” Warner Bros Chairman Samuel DiPiazza Jr. and CEO David Zaslav said in a publicly shared letter sent to the Paramount board on Tuesday.

“We continue to recommend and remain fully committed to our transaction with Netflix.”

The two media giants have been vying for control of Warner Bros., its flagship film and TV studios and deep content library, in a contest that highlights the high stakes of a rapidly shifting entertainment landscape.

A successful deal will give the suitor ownership of Warner Bros.’ extensive film and television library, which includes classics ranging from “Casablanca” and “Citizen Kane” to wildly popular favorites like “Friends” and “Batman.”

Warner Bros. said in its letter that it expects a bid above $31 per share, more so because a Paramount financial adviser had orally informed that if Warner Bros. reopens deal talks, Paramount would agree to this price, which is not its best offer.

“Time is running out for Paramount with this saga wrangling on, for way too long, which is in no one’s interest,” PP Foresight analyst Paolo Pescatore said. “For now, the ball is in Paramount’s court.”

Shares of Paramount rose 3.5%, while Warner Bros. Discovery was up 2.5% in premarket trading. Netflix shares were up about 1%.

Paramount’s current offer for the whole company comes to $108.4 billion, while Netflix is offering $27.75 a share, or $82.7 billion, just for its studio and streaming businesses.

During the talks that opened Tuesday, Warner Bros. Discovery said it will discuss “deficiencies that remain unresolved and clarify certain terms of PSKY’s proposed merger agreement.”

Vote on Netflix deal set for March 20

Warner Bros., which has rejected Paramount’s offers to buy the entire company, is moving forward with a vote on Netflix’s bid on March 20.

The merger, if approved, would take place after Warner Bros. spins off its Discovery Global cable operations, which include CNN, TLC, Food Network and HGTV, into a separate, publicly traded company.

Discovery Global could fetch between $1.33 per share and $6.86 a share, according to Warner Bros. estimates.

However, Warner Bros.’ decision to engage with Paramount marks a shift for the studio.

Paramount has said the board “never meaningfully engaged” with them on six different offers that executives made in the 12 weeks before Warner Bros announced the merger agreement with Netflix on Dec. 5. A hostile bid that Paramount launched days later was rejected later that month.

Activist pressure intensifies

Paramount’s revised offer, which included a personal guarantee on $40 billion in equity from Oracle founder Larry Ellison, father to Paramount CEO David Ellison, was turned down in early January.

The move to open talks with a rival bidder also comes as Warner Bros. faces mounting pressure from activist investor Ancora Holdings, which has built a stake in the company and plans to oppose the Netflix transaction.

Paramount is also pressing to add directors to Warner Bros. board, eyeing Pentwater Capital Management CEO Matt Halbower as a potential nominee, Halbower said last week. Pentwater, which owns about 50 million shares of Warner Bros, has backed Paramount’s bid.

“Every substantive complaint that the Warner Bros. board had with Paramount’s previous offer has been addressed,” Halbower said in an interview last week.

To start talks with Paramount, Warner Bros.’ board secured a special waiver from Netflix. Under their agreement, Warner Bros. can engage with a rival bidder only if the board believes the offer could be superior, triggering a legal loophole that allows limited negotiations despite restrictions on talks.

Netflix issued a statement saying the deal has reached a milestone, with Warner Bros. shareholders set to vote next month on the merger.

“While we are confident that our transaction provides superior value and certainty, we recognize the ongoing distraction for WBD stockholders and the broader entertainment industry caused by PSKY’s antics,” Netflix said, referring to Paramount Skydance Corp.

Financing concerns

Last week, Paramount made a new attempt to win over Warner Bros. shareholders by enhancing its previous bid without raising its offer of $30 per share.

Instead, Paramount has offered WBD’s shareholders extra cash for each quarter the deal fails to close after this year and agreed to cover the $2.8 billion breakup fee the HBO owner would owe Netflix if it walked away.

Warner Bros. said the amended merger agreement with Paramount still falls short of what its board would consider a superior proposal.

The Paramount offer still leaves key issues unresolved, including who would cover a potential $1.5 billion junior lien financing fee, what happens if debt financing falls through, and whether equity funding, backed by lead sponsor Larry Ellison, is fully certain, the Warner board wrote.

The letter said while Paramount has argued financing concerns are “not serious” given the “personal wealth of your lead equity sponsor and the credibility of your lending banks”, the draft agreements require that if debt financing becomes unavailable, additional equity must be funded to ensure the transaction can still close.

Ancora, which has a stake worth nearly $200 million, said last week Warner Bros’ board did not adequately engage in talks with Paramount Skydance over a rival offer for the whole company, including cable assets such as CNN and TNT.

The deal is also expected to face tough regulatory scrutiny on concerns over price increases for consumers and potential harm for creatives.

Paramount and Netflix have said they were engaging with competition authorities across the world, including the U.S. Department of Justice.

Economy

Iraqi-Emirati consortium plans $700M data cable to link UAE to Türkiye

A consortium between Iraq and the United Arab Emirates (UAE) is preparing to invest $700 million in a combined subsea and land-based data cable connecting the UAE to Türkiye via Iraq, according to one of the project’s backers.

The plan comes little more than a week after a Saudi-supported fiber-optic initiative was unveiled in Syria.

Gulf neighbors Saudi Arabia and the UAE are each trying to tap into demand for connectivity in the region and become hubs for AI infrastructure, including data centers, amid wider economic and geopolitical competition across the region.

The Iraqi-UAE project, branded WorldLink, would comprise an undersea cable from the UAE to Iraq’s Faw peninsula on the Gulf, which will then run overland north to the Turkish border, Ali El Akabi, head of Iraq’s Tech 964 – one of the three members of the consortium – told Reuters.

5-year program

El Akabi said the project would be privately funded and rolled out in phases over the next five years. It aims to ease congestion and reduce transit times versus the traditional paths that run through the Suez Canal.

Saudi Arabia and Syria announced on Feb. 7 plans to set up a fiber-optic network under a wider investment package.

That project, dubbed SilkLink, is a roughly $1 billion push to rehabilitate Syria’s infrastructure and position it as a data route between Asia and Europe.

In response to a request for comment on the UAE-Iraqi project, the Syrian Telecoms Ministry told Reuters in a statement: “Additional infrastructure investment improves route diversity and resilience for everyone.”

“SilkLink is designed to deliver low-latency and high-availability … and we expect to be highly competitive on both performance and resilience,” it said.

Besides Tech 964, WorldLink’s sponsors include Iraq-Kurdish DIL Technologies and UAE-based Breeze Investments.

“AI infrastructure readiness is a necessity as we witness its adoption worldwide,” said Nayef Al Ameri, chair of Breeze Investments, in a statement. “WorldLink is designed to deliver the fastest and most reliable connectivity in the region, serving these needs.”

Iraq, which is trying to market itself as a stable transit corridor after decades of conflict, launched a $17 billion “Development Road” rail-and-road plan in 2023 to connect Faw to Türkiye.

The strategic corridor is planned to link Grand Faw Port in Iraq’s oil-rich south to Türkiye and onward to Europe via a combined rail and highway network stretching more than 3,000 kilometers (1,865 miles).

The project aims to shorten travel time between Asia and Europe in a bid to rival the Suez Canal.

Economy

Hyatt hotel chain’s executive chair steps down over Epstein ties

The executive chair of the Hyatt hotel chain announced Monday that he will step down, after emails surfaced disclosing his connections to convicted sex offender Jeffrey Epstein.

U.S. businessperson Thomas Pritzker maintained contact with Epstein well after the latter was convicted of soliciting prostitution from a minor in 2008.

Epstein died in prison in 2019, awaiting charges of sex trafficking girls, in what was ruled a suicide.

“Good stewardship also means protecting Hyatt, particularly in the context of my association with Jeffrey Epstein and Ghislaine Maxwell which I deeply regret,” Pritzker said in a letter to the company’s board.

“I exercised terrible judgment in maintaining contact with them, and there is no excuse for failing to distance myself sooner,” Pritzker said in a statement.”

Maxwell, Epstein’s associate, is serving a 20-year sentence for her role in a conspiracy to traffic girls with the disgraced financier.

Hyatt, in a statement, said – without mentioning Epstein – that Pritzker would retire from his role as executive chairperson of the board of directors and that he would not seek reelection to the board at the company’s shareholders meeting in May.

Pritzker has served as executive chair since 2004 and highlighted the company’s growth and resilience during his tenure, including taking Hyatt public, adopting an “asset-light” strategy and navigating the COVID-19 pandemic.

U.S. media reported on an email exchange from 2018 where Epstein asked Pritzker to help secure reservations for a woman traveling in Asia.

The woman told Pritzker she was “going to try to find a new girlfriend for Jeffrey,” to which Pritzker replied: “May the Force be with you.”

Files on Epstein released by the U.S. government, including troves of his email correspondence, have exposed his ties to the rich and powerful around the world.

Many have resigned from their positions in scandal and tainted by association with Epstein, even if the files do not prove they committed a crime.

Pritzker is the cousin of Illinois Gov. JB Pritzker, a possible contender for the Democratic presidential nomination in 2028.

Economy

UK unemployment rate jumps to highest in over decade outside pandemic

Unemployment rate in Britain ticked higher toward the end of last year, reaching its highest level in more than ten years outside of the pandemic period, while wage growth continued to ease, according to data on Tuesday that adds to bets on a U.K. interest rate cut next month.

The jobless rate rose to 5.2% in the last three months of 2025, the highest since 2015 not including the pandemic, according to the data from the Office for National Statistics (ONS). It hit 5.3% in late 2020 and stood at 5.1% in the three months to November last year.

The unemployment rate is calculated from a survey that the ONS is in the process of overhauling after response rates dipped too low during the pandemic. However, analysts say the quality of the data has improved in recent months.

Sterling fell by more than half a cent against the dollar after the figures were published.

“Today’s data raises the prospect of the Bank of England (BoE) resuming cutting interest rates in March,” Yael Selfin, chief economist at KPMG UK, said.

Investors priced a roughly 73% chance of a quarter-point rate cut on March 19 at the BoE’s next meeting, up from 65% on Monday.

The data from the ONS showed weaker inflationary heat from growth in workers’ earnings.

Annual wage growth, excluding bonuses, slowed to 4.2% in the last three months of 2025 compared with the same period a year earlier, matching forecasts by most economists in a Reuters poll and down from 4.4% in the three months to November.

The BoE is watching pay as a gauge of how long Britain’s above-target inflation is likely to last.

Earlier this month, the central bank said previously strong wage growth in the private sector was starting to reflect the weakening of the jobs market.

Private sector annual wage growth excluding bonuses slowed to 3.4% in the three months to December, down from 3.6% in the three months to November.

Last week ONS data showed weaker-than-expected growth in the overall economy in the October-to-December period, hurt in part by speculation about tax increases in Treasury chief Rachel Reeves’ budget at the end of November.

There were some signs in the most recent figures included in Tuesday’s data release that the labor market might be stabilizing after taking a hit on Reeves’ increase last April in a tax paid by employers.

The number of people in payrolled employment fell by 11,000 people in January from December.

In December, payrolls fell by a revised 6,000, the smallest drop since August last year and a much softer fall than a provisional estimate of a plunge of 43,000.

-

Politics1 day ago

Politics1 day agoTürkiye condemns Israel’s ‘illegal’ move for West Bank land grabs

-

Daily Agenda2 days ago

Daily Agenda2 days ago“4th European Turkish Media Summit” was held in Germany

-

Daily Agenda2 days ago

Daily Agenda2 days agoStrong reaction from the Ministry of Foreign Affairs to Israel’s land registration in the West Bank: “It is a clear violation of international law and is void.”

-

Politics2 days ago

Politics2 days agoErdoğan hits the road for Gaza, Somalia, visits UAE, Ethiopia

-

Politics2 days ago

Politics2 days agoMalaysian ambassador says ties with Türkiye at strongest ever

-

Economy1 day ago

Economy1 day agoCloser look at Türkiye’s booming date trade as Ramadan nears

-

Politics1 day ago

Politics1 day agoErdoğan, UAE leader talk about expanding ties in phone call

-

Politics2 days ago

Politics2 days agoParliament seeks more input on key report for terror-free Türkiye